If you want to successfully run your business, one of the crucial skills to develop is finance management.

You need to know precisely what your numbers are, how much money you spend on growing the business, and how much profit you have.

The two most valuable principles for measuring success are ROI and ROAS. In this article, we will talk about ROI vs ROAS and try to determine which is a better measurement.

» The definition of ROI

Before we can talk about ROI vs ROAS, we need to know what each abbreviation stands for. ROI, or Return on Investment, is a phrase that,

in simple words, tells you how much money you spent and earned over a period of time. Whether you want to increase sales in e-commerce or retail, you need to know your ROI.

To calculate ROI, you take your net profit, divide it by net spend, and multiply it by 100. So, if you spend $5000 and earn $10000, you have an ROI of 100%.

It is essential to understand that your net spend includes total expenditures, like employee salaries, software fees, design, marketing, and any other expenses.

» The definition of ROAS

ROAS or Return on Advertising Spend is a formula that helps you calculate how much money you spent on advertising and how much your revenue is.

You will get your ROAS when you divide advertising revenue with the money spent on advertising and multiply it by 100.

To use the same example from above, if you spend $5000 on advertising and earn $10000 in revenue, you have a ROAS of 100%.

Even though these two look the same, there is a significant difference because ROAS includes only the money you spent on advertising.

» The difference between ROI and ROAS

Here is another example. Let’s say that you spend $5000 on advertising. Also, production costs, social media marketing tools, other software, and employee salaries all come up to $10000. You make $10000 in revenue.

Let’s calculate ROAS: 10000 (revenue) / 5000 (advertising spend) * 100 = 200% (positive ROAS).

Now, let’s calculate ROI: -5000 (profit: revenue – all expenses ) / 15000 (net spend, advertising + other expenditures) * 100 = -33.33% (negative ROI).

As we can see from this example, your advertising strategy has fantastic results. On $5000 advertising spend you were able to double the money.

However, your net spend is much higher, so your company has a negative ROI, which means that you are actually at a loss.

The major differences between ROI and ROAS are:

- ROI calculates profit, while ROAS calculates revenue;

- for ROI, you use total expenditures, and for ROAS, you only look at your advertising spend;

- having a positive ROAS does not mean you will have a positive ROI and vice versa;

ROI vs ROAS – which is better to use?

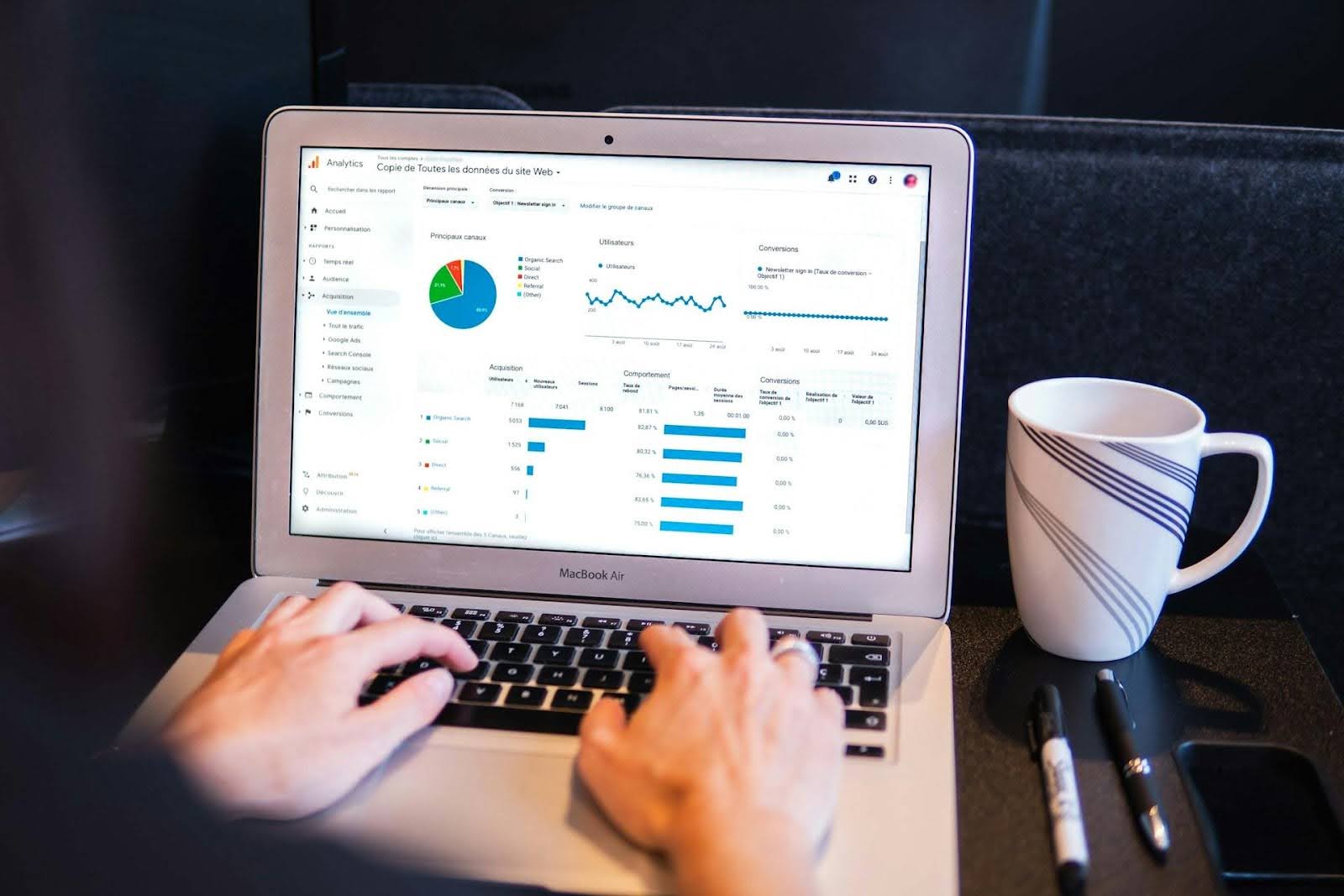

To understand which is better to use, ROI or ROAS, we spoke with marketing and sales teams from multiple industries, like retail, food, finance, moving, etc.

After an extensive conversation with professionals from Movers Development, we concluded that using ROAS and ROI is crucial for every business.

ROAS is a fantastic tool that helps you determine whether your advertising is efficient or not. Without it, you cannot tweak the performance of your ads.

On the other hand, ROI helps you to determine if your business is making or losing money.

How ROI helps your business

Using ROI is crucial to determine if you can spend more money on different activities. For example, buying office equipment.

Furthermore, hiring new employees works in the same way. If you have a positive balance, you can hire new people without hurting your financial state.

It is also possible to expand your company, open a new department, or finance new sales strategies if you have a positive ROI.

Using ROAS to grow your business

ROAS is an essential tool when it comes to improving your marketing strategy.

It can help you evaluate all of your marketing campaigns and see how efficient they are. That is an excellent way to find out what type of ads are most attractive to your clients.

When you know your ROAS, you can optimize multiple marketing campaigns and protect your budget. Keep in mind that spending more does not guarantee a higher revenue. However, spending more on suitable ads will definitely boost your ROAS.

This is especially important if you are using ads on Facebook or similar strategies.

Both ROAS and ROI improve your marketing strategies

As you can see, both ROI and ROAS play a crucial part in running your business. By having a positive Return on Investment,

you can determine whether you can form a budget for a new marketing campaign or not. On the other hand, ROAS helps you run that campaign effectively without overspending.

Another important fact is that you should always look at ROI first because it gives you a more precise calculation of your performance. If you don’t have a positive ROI, you need to work on fixing whatever the problem is before you can spend additional money on marketing.

Still, sometimes a marketing campaign is just what you need to fix your ROI, and that’s where ROAS plays a crucial role. With correct calculations, you can actually create positive revenue and give a financial boost to your company.

Key takeaways for using ROI and ROAS

The most important thing to remember is that we are not talking about ROI vs ROAS, but ROI and ROAS. Both of these calculations are important for the success of your company.

Just remember that ROI gives you your net profit when all expenditures are subtracted. If you have financial issues but don’t know why doing ROAS calculations can also be beneficial.

It will tell you if the problem is in your advertising campaigns or not. If they perform with a positive revenue, that means your problem lies somewhere else.

Therefore, remember to use both ROI and ROAS to grow your business.

Read More:

- Top 10 Effective SEO Trends To Be Well Followed

- The Ultimate Guide To Keyword Research For SEO (Updated)

- How To Optimize Your Site Structure For SEO